Not All Social Is Social podcast

Learn from our fraud experts about online fraud and how it affects consumers in Ireland. Understand more about the psychological tactics used by fraudsters to trick you into falling for their scams. And get the guidance and steps you need to stay safe, which you can share with your family and friends.

Stop, Think, Check. And together, we won’t let the fraudsters win.

Purchase scams and shopping online

Fraudsters are highly skilled at creating fake websites that appear genuine and persuade shoppers to share their payment information. Fake adverts can even be found on genuine sites or you may even find an advert after seeing someone you know sharing it online. Many scams are centred around vehicles like camper vans and tractors, while others create websites to look like well-known companies like clothing brands.

Purchase scams

Using social media

The more information you post online, the more you put yourself at risk of becoming a potential target for fraudsters. For example, if a fraudster obtains your full date and place of birth, they could try to use this information to access your accounts.

Using social media

Smishing texts

Fraudsters may send texts pretending to be from Bank of Ireland, motorway toll services, utility companies and other trusted providers. The texts urge customers to pay charges or update account details. They have links to fake websites that ask for your card or online banking details.

Smishing texts

Investment and Recovery agent Scam

Fraudsters are seizing the opportunity of the current low interest rate environment by offering people high interest returns on various investments, particularly in crypto-currency. Fraudsters can be very convincing, they may have created a professional and legitimate looking company website. If it’s too good to be true it probably is.

If you have been victim of investment fraud you maybe re-targeted by a ‘Recovery Agent’. These recovery agents can seem genuine and make promises that they have recovered your money, but they require an upfront administration fee to release the funds back to you.

Investment scams

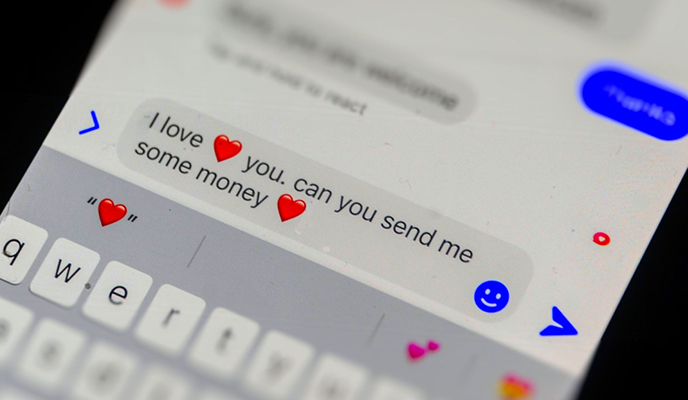

Family impersonation scams

Fraudsters are sending texts pretending to be from a family member with a lost or damaged phone, in need of money. These texts usually follow a similar format each time, opening with “Hi Mum/Hi Dad, this is my temporary/new number…” and followed by a request for help to pay for something urgently.

Impersonation scams

Phishing emails

Fraudsters sometimes send emails pretending to be from your bank, credit card company or another company you trust. They often ask you to click on a link or open an attachment. The emails may seem genuine and convincing but are designed to trick you into sharing your personal information. They will often make urgent threats and try to scare you into giving away your details.

Phishing emails

Vishing calls

Be vigilant if you receive a phone call out of the blue from someone claiming to be from your bank, credit card company or another company you trust. They may claim that your account has been compromised and ask you for your bank card or bank account details.

Vishing calls

Romance scams

Romance fraud is when a fraudster builds a fake persona and relationship with a victim to gain their trust and to trick them into sending money. Fraudsters set up a fake profile on social media or dating apps/websites to meet and then exploit their victims. Romance scams can last a long time as the fraudster gradually builds trust.

Romance scams

Remote access fraud

Fraudsters sometimes make “cold calls”, pretending to be from a reputable technical support, IT company or bank. They try to convince you to let them take control of your computer remotely over the phone so that they can fix, upgrade, or protect your device. They may ask you to log on to your online banking account or ask for bank, credit card or other personal details.

Remote access fraud

Money mules

Offers to make quick and easy money can seem appealing but this is a way that fraudsters use people as ‘money mules’. Young people and students are often being targeted and recruited as money mules. They receive stolen money into their account, then transfer it to another account, usually overseas, and keep some of the cash for themselves as ‘payment’ or withdraw the cash and pass it on to the money mule recruiter.

Money mules

Card and ATM safety

Help keep your money safe by knowing how to protect your bank cards and PIN and what to look out for when using an ATM.

Card and ATM safety

Using public Wi-Fi

When you access public Wi-Fi, you can never be sure who has set up the network and, more importantly, you don’t know who is connected to it. Malicious users could intercept anything you are doing online including capturing your passwords and reading private emails.

Using public Wi-Fi

Protect your devices

By clicking on a fake link in an email, text, your social media account, or on a pop-up ad online, you could be allowing malware to download and infect your device. Make sure that you properly protect your mobiles, tablets, laptops or computers to help safeguard against fraud.

Protect your devices

Use strong passwords securely

Using a strong password makes it harder for fraudsters to gain access to your online accounts. A weak password can be cracked in less than five minutes.

Make sure you know the recipe for creating strong passwords and how to keep them safe.

Identity theft

Identity theft occurs when a fraudster steals your personal information and uses it to impersonate you. They can carry out fraudulent activity such as trying to access your bank accounts, opening a credit card account in your name or getting payment from a supplier.

Identity theft

QR code scams (quishing)

Quishing is when a fraudster creates a QR ('quick response') code that directs you to a fake website. The fake website looks genuine and asks you for personal and/or financial information, it could also infect your phone with malware. The fraudster then uses the information you have provided to attempt to steal your money and/or identity.

QR code scams

Pension scams

Pension scams, also known as ‘pension loans’ and ‘pension liberation’, are scams that try to get you to move your pension pot to another plan. Fraudsters lure people by offering them early access to funds. Early access to your pension savings can lead to tax charges and huge penalties.

Pension scams