Strong Customer Authentication – SCA

Strong Customer Authentication (SCA)

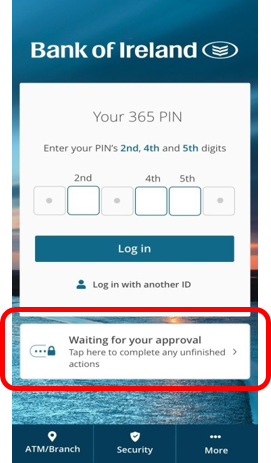

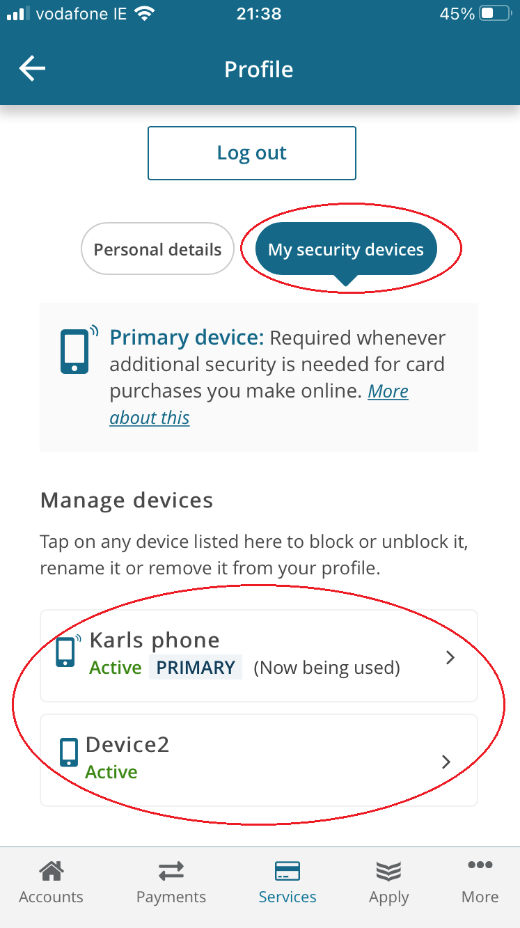

Strong Customer Authentication or SCA is an extra layer of security we’ve added to help make online card payments safer. It works through your mobile phone or tablet.

To use it, you must download the latest version of the BoI app and make sure we have an up-to-date mobile phone number for you.

Most frequently asked questions

General FAQs (Frequently Asked Questions)

SCA Brochure

Personal Debit Card

A Guide to Strong Customer Authentication (SCA)

Personal Credit Card

A Guide to Strong Customer Authentication (SCA)

Business Debit Card (Single Card)

A Guide to Strong Customer Authentication (SCA)

Business Debit Card (Multiple Cards)

A Guide to Strong Customer Authentication (SCA)

Voice Recording

Voice Recording – A Guide to Strong Customer Authentication’

*This page will be updated regularly, please check back soon for further updates.