Seven in ten don’t trust social media companies to protect them from fraud

Bank of Ireland warns about new ‘pump and dump’ Meta investment scam

Seven in ten social media users do not trust social media companies to protect them from fraud and nearly three-quarters (73%) distrust the ads they see on these platforms. Research commissioned by Bank of Ireland for its latest fraud awareness campaign also reveals that 91% believe social media firms should be banned from profiting off fraudulent ads, while 90% say that financial service advertisers on social media should be required to prove their legitimacy.

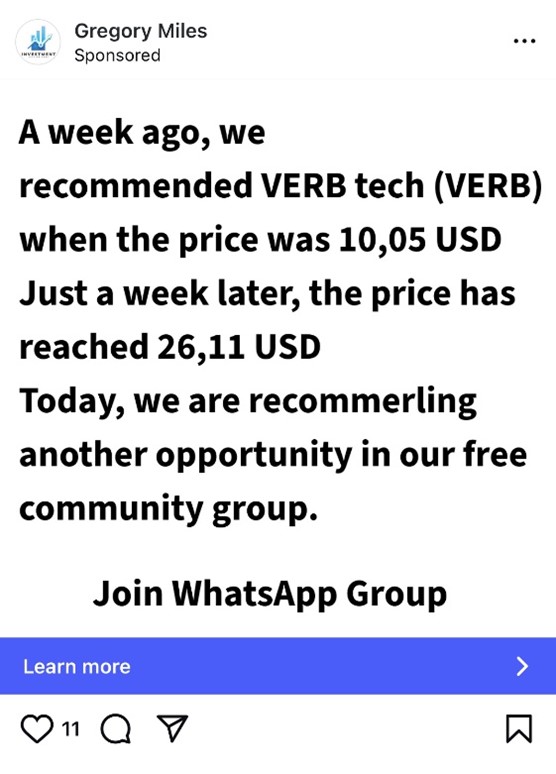

Bank of Ireland is also issuing a warning about ‘pump and dump’ WhatsApp investment scams. Fraudsters lure victims via fake social media ads to join an investment WhatsApp group. Posing as a financial investment expert, the fraudster then spreads misleading information to group members about particular companies/stocks. Group members then buy the stock, the price is pumped up due to the increased demand and when the price peaks, the scammers sell (dump) their holdings at a profit, and disappear.

Bank of Ireland fraud research (conducted by Red C, August 2025) reveals:

- 83% of consumers believe that fraud is a big problem in society today

- 76% say that the risk of fraud scams makes them wary when they shop online

- 69% of social media users don’t trust social media companies to protect users from fraud

- 73% of those who use social media now don’t trust adverts on social media

- 86% of those seeing fraudulent content on social media platforms saw it on Meta platforms

- 90% feel that companies that advertise financial services on social media platforms should have to prove that the ads are genuine and the company is registered with the Central Bank of Ireland

Nicola Sadlier, Head of Fraud, Bank of Ireland said: “Social media platforms have become a lucrative hunting ground for fraudsters and consumers are paying the price while technology giants gain revenue. As we launch our new fraud awareness campaign highlighting scams originating via social media, a new spate of ‘pump and dump’ investment fraud is spreading fast, mainly using WhatsApp.

‘With results from the Latest REC C survey, seven in ten consumers now distrusting social media companies to shield them from fraud, and over 90% demanding an end to platforms profiting from scam ads, the message is clear – the public wants protection. It’s time for increased accountability, not just algorithms’

Bank of Ireland’s new fraud awareness campaign launches with the theme ‘Not all social is social’, highlighting the threat of fraud originating via social media platforms. The Bank’s consumer and business fraud education campaign for 2025 focuses on key fraud themes: Investment scams, CEO fraud, invoice redirection, smishing and fake online purchases. The digitally-led media campaign provides actionable advice from Bank of Ireland’s fraud prevention experts and international cyberpsychologist, Professor Mary Aiken, to protect customers’ financial wellbeing. Through extensive public affairs and PR activity, the Bank has been campaigning for a change in legislation to better protect consumers from fraud originating on social media channels.

Professor Mary Aiken said: “Fraud online is now an industrialised, platform-enabled phenomenon. Scammers leverage the same targeting and engagement tools legitimate advertisers use; the difference is that families and businesses bear the cost.

“Bank of Ireland’s findings, which show that seven in ten users distrust platform protection and over 90% want an end to profits from scam ads, reveal an overwhelming public appetite for reform. ‘Not all social is social’, much of it is commercial, algorithmic and adversarial. The solution is safety by design, verifying financial advertisers, building friction and warnings into investment journeys, and enforcing clear accountability when systems enable harm. If platforms can target us to buy, they can target protections to keep us safe.”

Anyone who suspects they have been a victim of fraud should contact their bank immediately so that the bank can try to stop the fraud and try to recover funds. Bank of Ireland customers can call the Fraud Team 24/7 on the Freephone line 1800 946 764.

For advice and information on how to stay safe from fraud, visit the Security Zone on the Bank of Ireland website.

ENDS

Note to editors:

The Red C research was conducted with a nationally representative sample of 1,004 consumers 18+ in Republic of Ireland, conducted 31st July – 5th August 2025.

How does the ‘pump and dump’ WhatsApp investment scam work?

- Scammers Buy Cheap Assets

- Fraudsters purchase large amounts of a low-volume, low-price stock or cryptocurrency—often obscure or illiquid.

- Pump Phase: Hype Creation

- They create WhatsApp groups (or use Telegram, Discord, etc.) and pose as financial experts or insiders.

- They spread false or misleading information about specific companies/stocks.

- Victims Buy In

- As more people believe the hype and buy the asset, the price artificially inflates due to increased demand.

- Dump Phase: Scammers Sell

- Once the price peaks, the scammers sell their holdings at a profit

- This sudden sell-off causes the price to crash, leaving victims with worthless or devalued assets.

- Group Disappears

- The WhatsApp group is often deleted or abandoned, and the scammers move on to repeat the scheme elsewhere.

Examples of financial scams: