Seasonal factors behind the rise in unemployment rate to 5%

Bank of Ireland’s latest economic update analyses the sharp rise in the Ireland’s unemployment rate to 5% this summer, suggesting seasonal factors such as the closure of schools and universities, the Celtic Tiger era baby boom and the associated surge in youth unemployment may be distorting unemployment temporarily upwards.

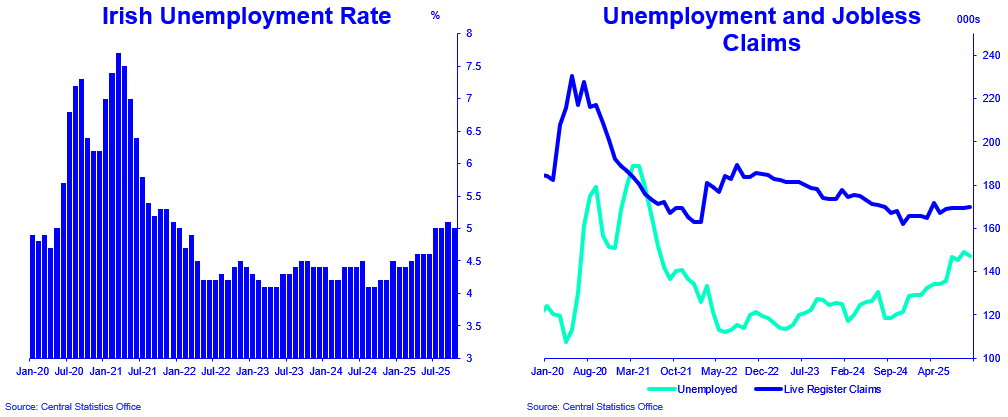

The bigger picture is that Ireland’s rapid 3% pace of job creation is slowing to a more sustainable level as bottlenecks and labour shortages are being increasingly felt. After reaching a 25-year low of 4.0% in June 2025, the unemployment rate was revised up to 4.6%, and has now climbed to 5.0%, with October’s figures confirming the trend. Next week’s Labour Force Survey for Q3 2025 will almost certainly confirm these figures.

Seasonal factors may be influencing these movements, with the third quarter of the year typically seeing temporary increases in unemployment due to school and university closures. This year’s spike appears concentrated among younger workers.

Youth unemployment (those aged 15 – 25) surged from 11.2% in June to 13.4% in October, accounting for roughly 40% of the rise in the aggregate unemployment rate. Demographic trends, including a larger cohort of school leavers following the Celtic Tiger-era baby boom (number of births rose from 61,400 in 2005, to a peak of 77,200 in 2010) now seeking employment, may also be contributing.

Discussing the latest update, Conall Mac Coille, Chief Economist, Bank of Ireland said: “The CSO data indicates unemployment has increased from 121,000 to 147,000 over the past twelve months. However, it is striking that the number of Live Register jobless claims has been flat over the same period, up just 1% over the past twelve months from 164,000 in October 2024 to 166,000 in October 2025, and still close to the lowest level since 2007.”

“The same is true of the key June and July peak-summer months, which saw the recent uptick in the unemployment rate from 4.6% to 5.1%. This can be viewed in the context of it being a temporary rise in the unemployment rate, which could well reverse in the Q4 Labour Force Survey to be published in February 2026.”

The CSO’s estimate of employee numbers (based off income tax returns) indicated jobs growth had slowed to 1.7% in August, to 2.56 million. Employment growth is slowing from exceptional 3% rates to a more sustainable, consistent pace. Nonetheless, the recent rise in the unemployment rate to 5% likely overstates the extent of the true slowdown in the labour market.