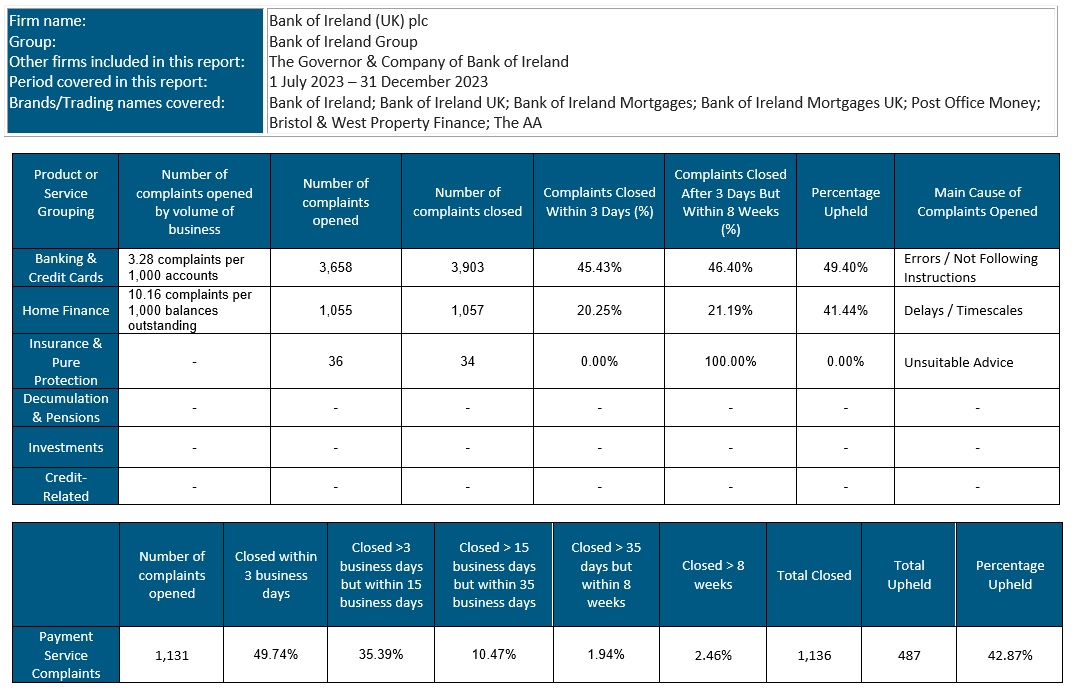

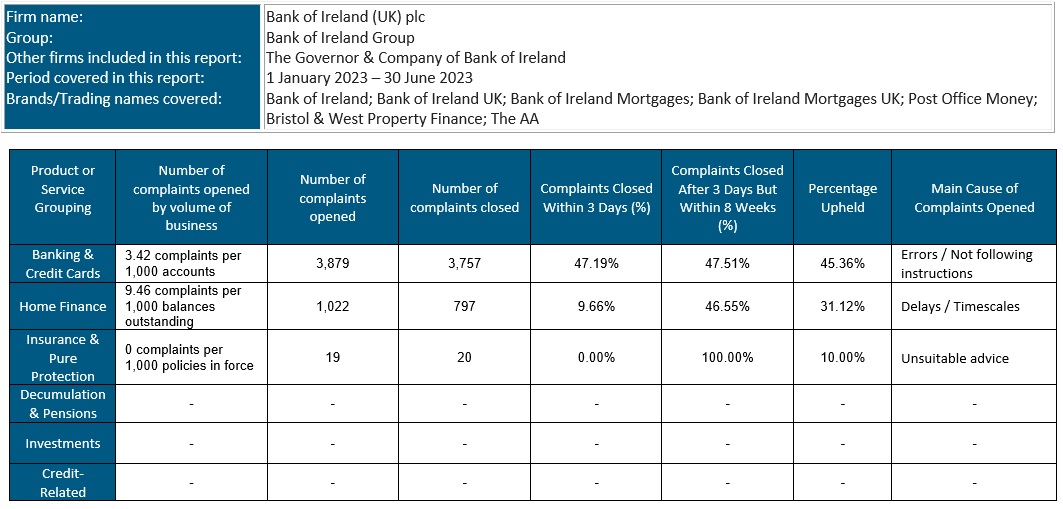

Complaints Performance Data Publication – Bank of Ireland (UK) plc: 1 January – 30 June 2023

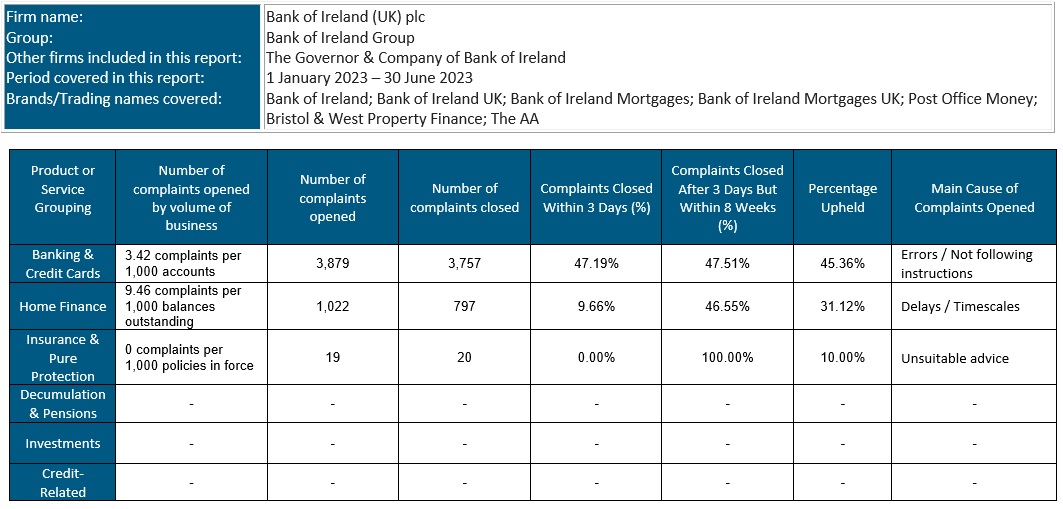

For more information on our performance in managing complaints (in our UK business) please see the table below. We are required to report total complaint activity for the period of 1 January 2023 to 30 June 2023.

Source: BOIUK Plc Customer Relations

*Please note, this data reflects the total time taken to reach a conclusion and we have not deducted time while we were waiting for a customer to reply to us.

To help you put these figures into context:

- 97% of customers who complained to us were satisfied with the way we handled their complaint and chose not to refer the matter to the Financial Ombudsman Service for independent adjudication;

- On 78% of the cases that the Financial Ombudsman Service adjudicated on, they concluded that the outcome reached by Bank of Ireland (UK) plc was fair;^

- On average, Bank of Ireland (UK) plc upholds 42.72% of all complaints we receive;

- Bank of Ireland (UK) plc resolves 88.02% of all complaints within 8 weeks of receiving them.

^ Source: Financial Ombudsman Service, March 2023

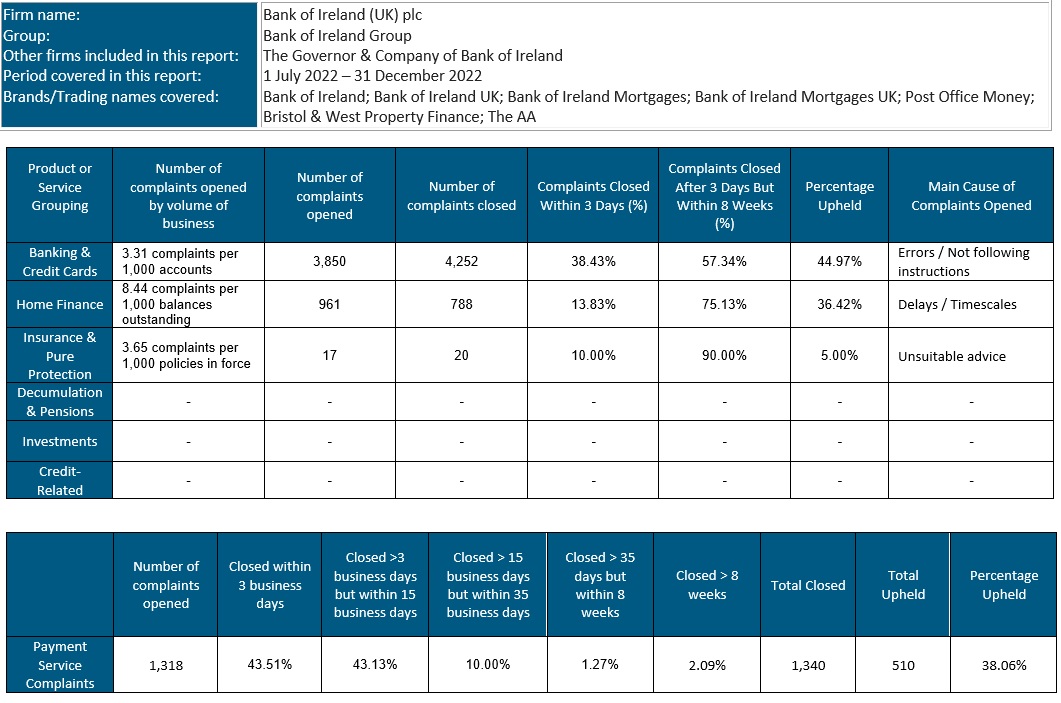

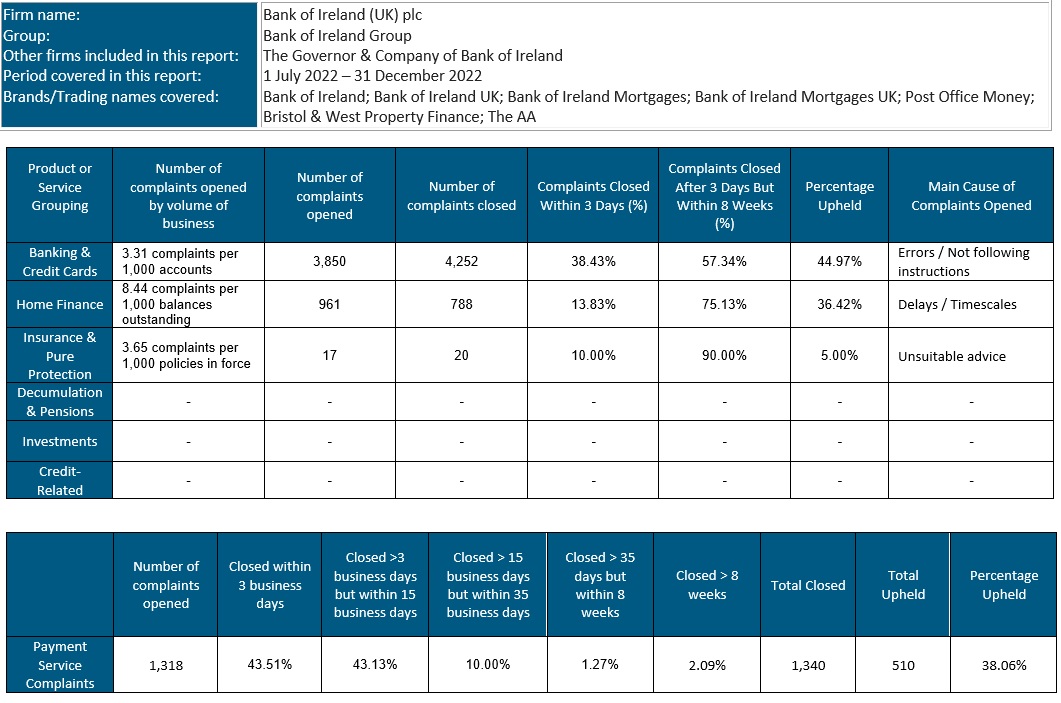

Complaints Performance Data Publication – Bank of Ireland (UK) plc: 1 July - 31 December 2022

For more information on our performance in managing complaints (in our UK business) please see the table below. We are required to report total complaint activity for the period of 1 July to 31 December 2022, and also complaints linked to a payment service activity (second table) for the period of 1 January to 31 December 2022.

Source: BOIUK Plc Customer Relations

*Please note, this data reflects the total time taken to reach a conclusion and we have not deducted time while we were waiting for a customer to reply to us.

To help you put these figures into context:

- 97% of customers who complained to us were satisfied with the way we handled their complaint and chose not to refer the matter to the Financial Ombudsman Service for independent adjudication;

- On 80% of the cases that the Financial Ombudsman Service adjudicated on, they concluded that the outcome reached by Bank of Ireland (UK) plc was fair;^

- On average, Bank of Ireland (UK) plc upholds 43.48% of all complaints we receive;

- Bank of Ireland (UK) plc resolves 94.72% of all complaints within 8 weeks of receiving them.

^ Source: Financial Ombudsman Service, September 2022

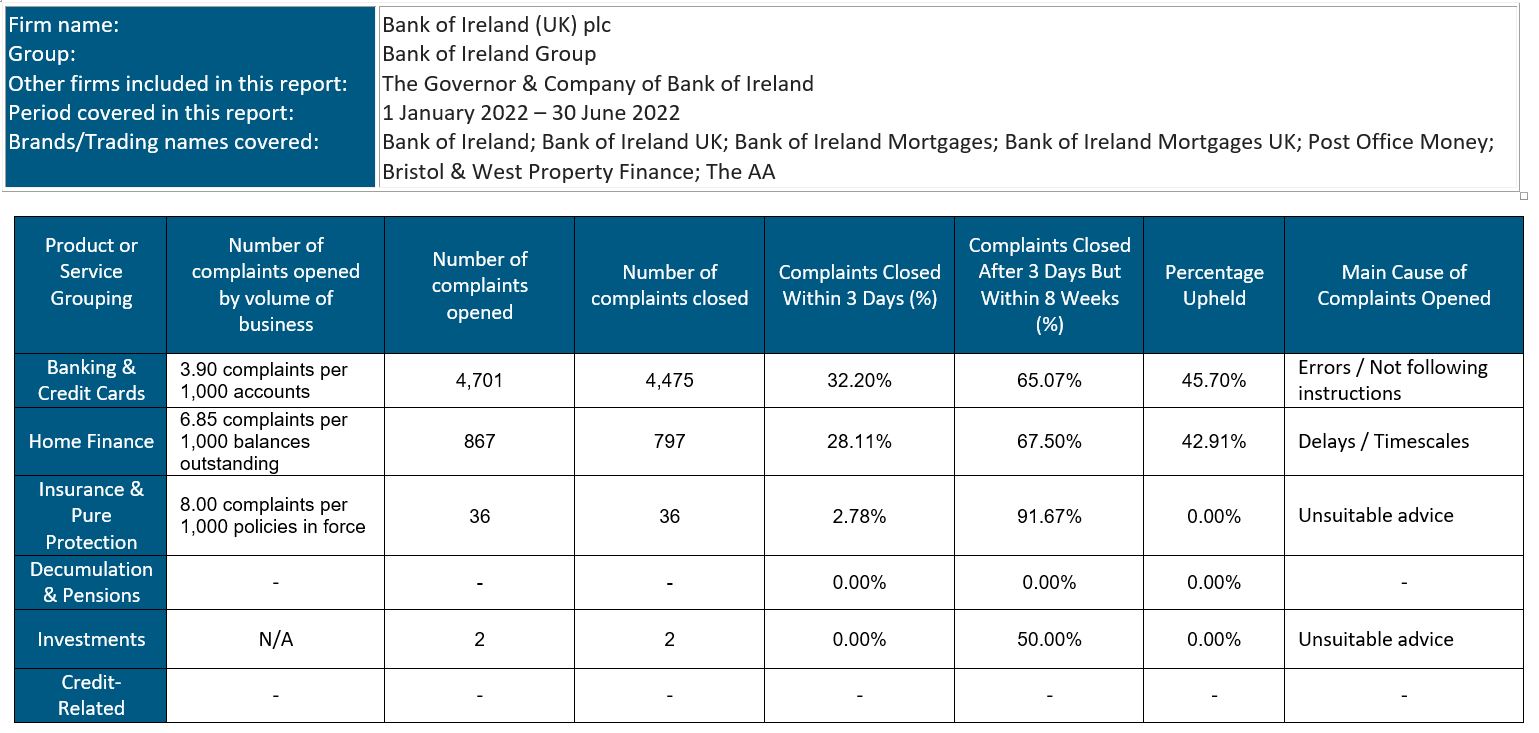

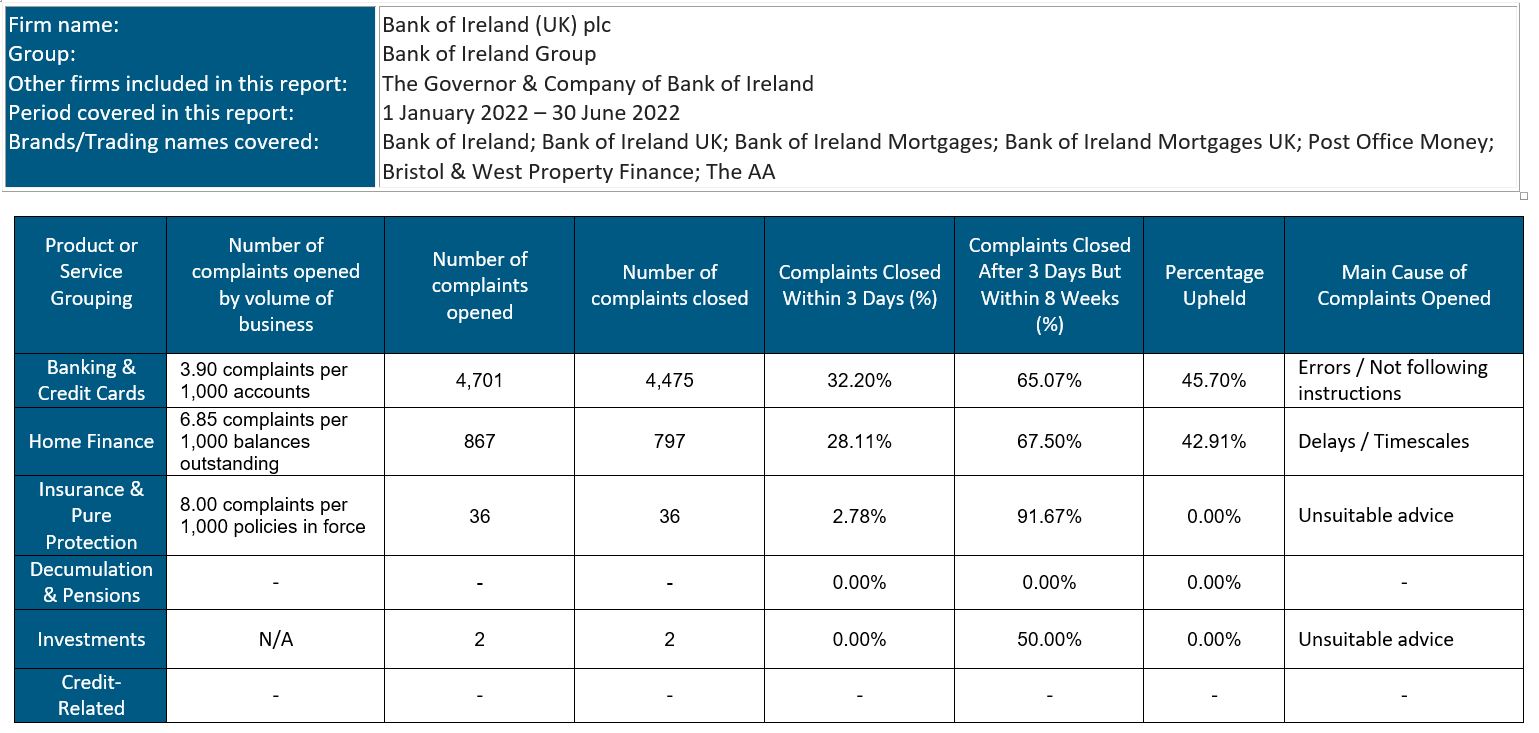

Complaints Performance Data Publication – Bank of Ireland (UK) plc: 1 January - 30 June 2022

For more information on our performance in managing complaints (in our UK business) please see the table below. We are required to report total complaint activity for the period of 1 January to 30 June 2022.

Source: BOIUK Plc Customer Relations

*Please note, this data reflects the total time taken to reach a conclusion and we have not deducted time while we were waiting for a customer to reply to us.

To help you put these figures into context:

- 97% of customers who complained to us were satisfied with the way we handled their complaint and chose not to refer the matter to the Financial Ombudsman Service for independent adjudication;

- On 75% of the cases that the Financial Ombudsman Service adjudicated on, they concluded that the outcome reached by Bank of Ireland (UK) plc was fair;^

- On average, Bank of Ireland (UK) plc upholds 44.94% of all complaints we receive;

- Bank of Ireland (UK) plc resolves 96.97% of all complaints within 8 weeks of receiving them.

^ Source: Financial Ombudsman Service, April 2022

Complaints Performance Data Publication – Bank of Ireland (UK) plc: 1 July - 31 December 2021

For more information on our performance in managing complaints (in our UK business) please see the table below. We are required to report total complaint activity (first table) for the period of 1 July to 31 December 2021, and also complaints linked to a payment service activity (second table) for the period of 1 January to 31 December 2021.

Source: BOIUK Plc Customer Relations

*Please note, this data reflects the total time taken to reach a conclusion and we have not deducted time while we were waiting for a customer to reply to us.

To help you put these figures into context:

- 96% of customers who complained to us were satisfied with the way we handled their complaint and chose not to refer the matter to the Financial Ombudsman Service for independent adjudication;

- On 79% of the cases that the Financial Ombudsman Service adjudicated on, they concluded that the outcome reached by Bank of Ireland (UK) plc was fair;^

- On average, Bank of Ireland (UK) plc upholds 46.12% of all complaints we receive;

- Bank of Ireland (UK) plc resolves 97.27% of all complaints within 8 weeks of receiving them.

^ Source: Financial Ombudsman Service, November 2021

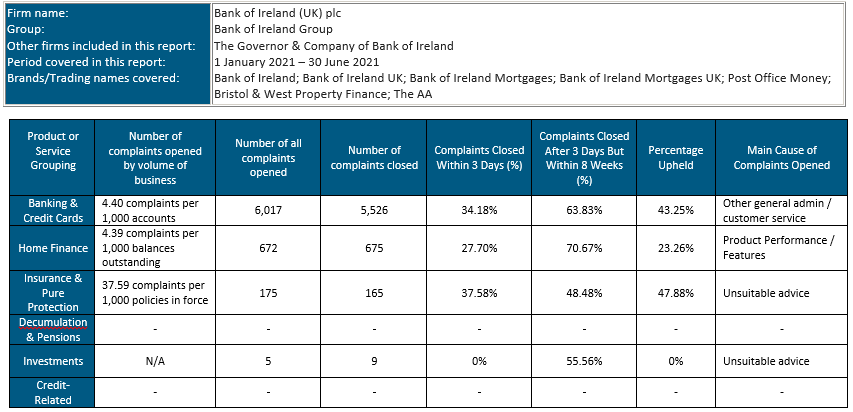

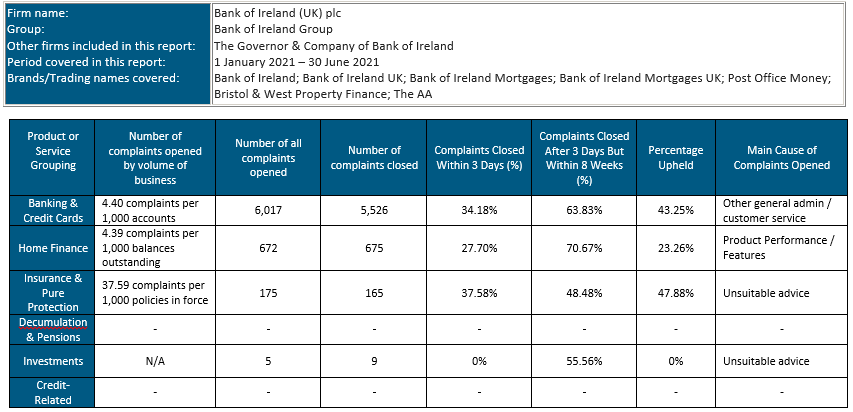

Complaints Performance Data Publication – Bank of Ireland (UK) plc: 1 January – 30 June 2021

For more information on our performance in managing complaints (in our UK business) please see the table below.

Source: BOIUK Plc Customer Complaints

*Please note, this data reflects the total time taken to reach a conclusion and we have not deducted time while we were waiting for a customer to reply to us.

To help you put these figures into context:

- 97% of customers who complained to us were satisfied with the way we handled their complaint and chose not to refer the matter to the Financial Ombudsman Service for independent adjudication;

- On 83% of the cases that the Financial Ombudsman Service adjudicated on, they concluded that the outcome reached by Bank of Ireland (UK) plc was fair;^

- On average, Bank of Ireland (UK) plc upholds 41.19% of all complaints we receive;

- Bank of Ireland (UK) plc resolved 97.68% of all complaints within 8 weeks of receiving them.

^ Source: Financial Ombudsman Service, March 2021

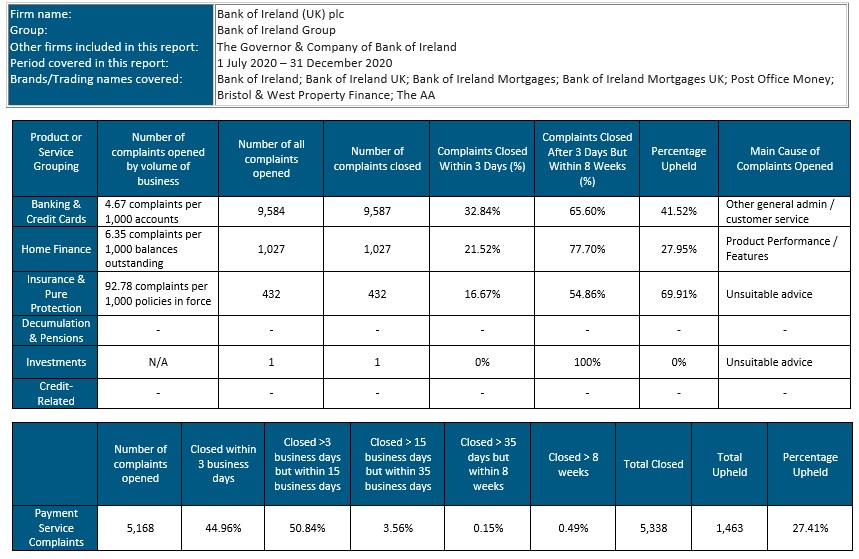

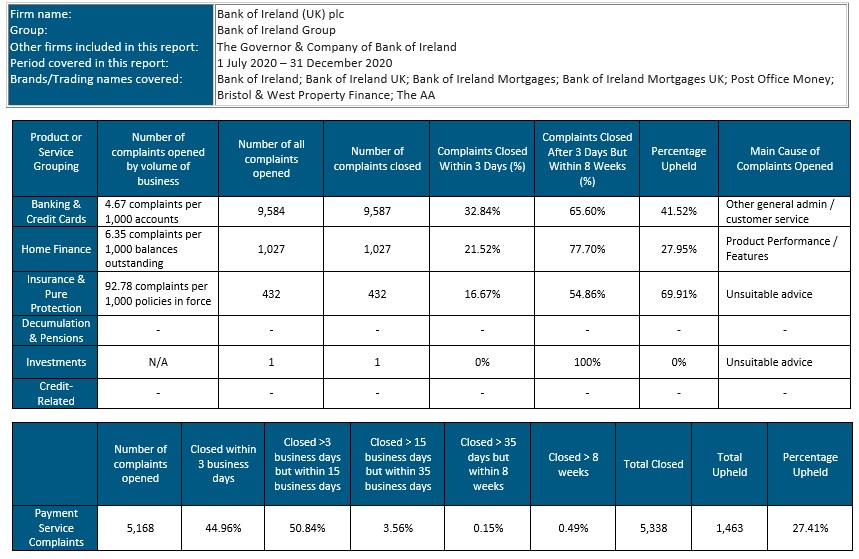

Complaints Performance Data Publication – Bank of Ireland (UK) plc: 1 July - 31 December 2020

For more information on our performance in managing complaints (in our UK business) please see the table below. We are required to report total complaint activity (first table) for the period of 1 July to 31 December 2020, and also complaints linked to a payment service activity (second table) for the period of 1 January to 31 December 2020.

Source: BOIUK Plc Customer Complaints

*Please note, this data reflects the total time taken to reach a conclusion and we have not deducted time while we were waiting for a customer to reply to us.

To help you put these figures into context:

- 97% of customers who complained to us were satisfied with the way we handled their complaint and chose not to refer the matter to the Financial Ombudsman Service for independent adjudication;

- On 81% of the cases that the Financial Ombudsman Service adjudicated on, they concluded that the outcome reached by Bank of Ireland (UK) plc was fair;^

- On average, Bank of Ireland (UK) plc upholds 41.37% of all complaints we receive inclusive of PPI, this reduces to 40.21% when PPI is removed;

- Bank of Ireland (UK) plc resolved 97.46% of all complaints (inclusive of PPI) within 8 weeks of receiving them. Excluding PPI, Bank of Ireland (UK) plc resolves 98.51% of complaints within 8 weeks of receiving them.

^ Source: Financial Ombudsman Service, September 2020