Bank of Ireland redesigns fixed rates with ‘EcoSaver Mortgage’

- Bank of Ireland transforms pricing of fixed rate mortgages to align with Building Energy Ratings (BER)

- The only product in the market that rewards all homeowners who have a BER

Bank of Ireland is redesigning the pricing structure of its fixed rate mortgages to align with energy ratings. Bank of Ireland’s ‘EcoSaver Mortgage’ is launching on 18th April with discounted fixed rates for all properties with a Building Energy Rating (BER), from A to G.

EcoSaver Mortgage will be available to new customers and also to existing customers who move to the new product from another Bank of Ireland mortgage product. In addition, customers with EcoSaver Mortgage will be rewarded for energy upgrades made to their property, with each BER improvement bringing a larger discount to the EcoSaver rate.

There are a number of ways existing customers can get EcoSaver Mortgage. Fixed rate customers can wait until their current fixed rate expires and move to EcoSaver Mortgage at that point, or they can break out of their current fixed rate and change to an EcoSaver Mortgage. However, breaking out of a current fixed rate term may not provide a saving if the customer is already on a lower fixed rate than what is currently offered by Bank of Ireland. There may also be a cost to end a fixed rate term early. Non fixed rate customers may elect to switch to Ecosaver Mortgage and get a fixed rate at any point. Customers are always advised to consider the options carefully before changing their mortgage rate.

Alan Hartley, Director of Homebuying, Bank of Ireland said: “The concept behind EcoSaver is simple – the more energy efficient your home becomes, the more your EcoSaver mortgage interest rate reduces. Almost three quarters of the housing stock in Ireland is BER C and lower. Uniquely in the market, EcoSaver gives a range of tiered discounts for all properties with a BER, from A to G, a fairer situation for all homeowners. We haven’t seen any other mortgage product from banks across Europe which provides discounts to such a range of properties.

“Bank of Ireland is committed to almost halving the carbon emissions of our mortgage loan book by 2030. EcoSaver will help us on that journey and support the State’s National Retrofit Plan. We are completely transforming our fixed rate mortgage pricing by providing discounts for a wide range of properties with a BER because we believe it’s the right thing to do. Over time it will encourage more retrofitting and contribute positively towards the environment.”

Aine McCleary, Group Chief Customer Officer, Bank of Ireland said: “Our research shows that six in ten homeowners plan to retrofit their home at some stage in the future and one in ten already has. Savings made through EcoSaver rates will contribute to the cost of retrofitting a home, so our customers can save money and improve their homes. And for customers who aren’t currently in a position to invest in their homes, they can still benefit from an EcoSaver discount if they have any BER.”

To coincide with the start of Bank of Ireland’s EcoSaver Mortgage (18th April), an online hub will help customers understand their current energy rating, as well as the work required and costs to achieve a better BER. An online retrofitting calculator will show the cost of retrofitting and the potential savings due to lower EcoSaver mortgage rates.

Bank of Ireland has partnered with SSE Airtricity to provide BER assessments to its customers, as well as assessments of works, quotes and home retrofitting services via their one stop shop. “We recognise there are challenges in the market with regard to availability of suppliers and retrofit specialists. Partnering with SSE Airtricity should bring synergies and improve the process for customers,” said Alan Hartley, Director of Homebuying, Bank of Ireland.

Customers undertaking work to improve the energy efficiency of their home may be able to avail of Bank of Ireland’s Green home improvement loan, the Bank’s lowest available variable rate home improvement loan.

From 18 April also, Bank of Ireland’s Standard Variable Rate (SVR) for owner occupiers will be a single rate of 4.15%. This rate is in line with the lowest rate Bank of Ireland currently offers for any Standard Variable Rate LTV mortgage and all new and existing customers. Existing customers applying for the new rate can contact us or visit our website from 18th April. This rate will not be eligible for cashback.

New standard variable interest rates available (no cashback)

Rate

Private Dwelling House Standard Variable Rate

4.15% (APRC 4.3%)

Buy to Let (investor) Standard Variable Rate

4.85% (APRC 5.1%)

Notes to editor:

How Bank of Ireland EcoSaver Mortgage works:

As your Building Energy Rating (BER) improves, your mortgage rate reduces.

- New customers – the interest rate on your mortgage will depend on the BER of the property you purchase. The more energy efficient (the better BER) the home you purchase, the greater the discount on your mortgage rate.

- Existing homeowners moving to EcoSaver from another Bank of Ireland mortgage product – the discount on your mortgage rate will be directly related to your BER – as you improve the energy efficiency of your home (and increase the BER), the greater the discount you can get. You can make smaller step-by-step changes over time, or get everything done at once with a full retrofit. Any eligible discount will be applied upon completion of your project. Just supply the new improved BER certificate to avail of the discount.

If you already have a fixed rate mortgage with Bank of Ireland, there are two ways that you can get EcoSaver Mortgage:

1. You can wait until your current fixed rate expires. We will write to you about two months before that maturity date and offer you EcoSaver Mortgage. At this time, you will need to have an up-to-date BER cert to get the EcoSaver Mortgage discount.

OR

2. If you want to, you can break your current fixed rate and get EcoSaver Mortgage. But please note that:

- The EcoSaver Mortgage discounts being offered are discounts based off the standard fixed rates we offer today. They may not give you a saving if you are on a fixed rate that is cheaper than the rates we offer today, even with an EcoSaver Mortgage discount.

- You may have to pay us compensation to break out of your current fixed rate, before its maturity date. Please contact us before you break a fixed rate, to find out if you have to pay compensation and, if so, how much it will be.

If you are a variable or tracker interest rate customer and want to get EcoSaver Mortgage which is a fixed interest rate, please note that:

- You will need to have an up-to-date BER cert to get the EcoSaver Mortgage discount.

- All Ecosaver Mortgages are fixed rates, not variable rates. They may be more expensive than your present variable or tracker interest rate.

- Unlike a fixed rate, there will never be a charge for moving from your variable mortgage interest rate.

- If you move from a tracker rate to an Ecosaver Mortgage fixed rate, when it ends you will not be able to return to a tracker interest rate (or to certain other variable rate products).

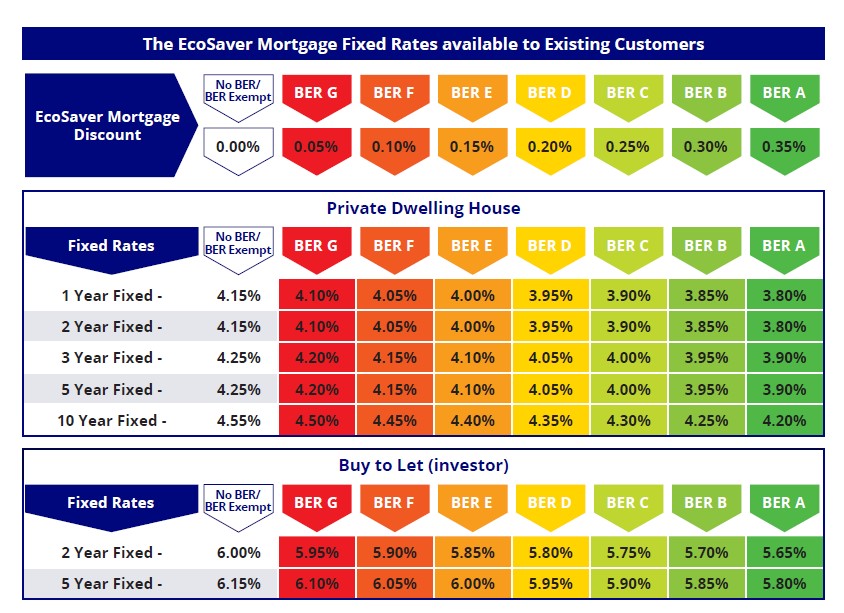

What are the EcoSaver Mortgage rates for existing mortgage customers?

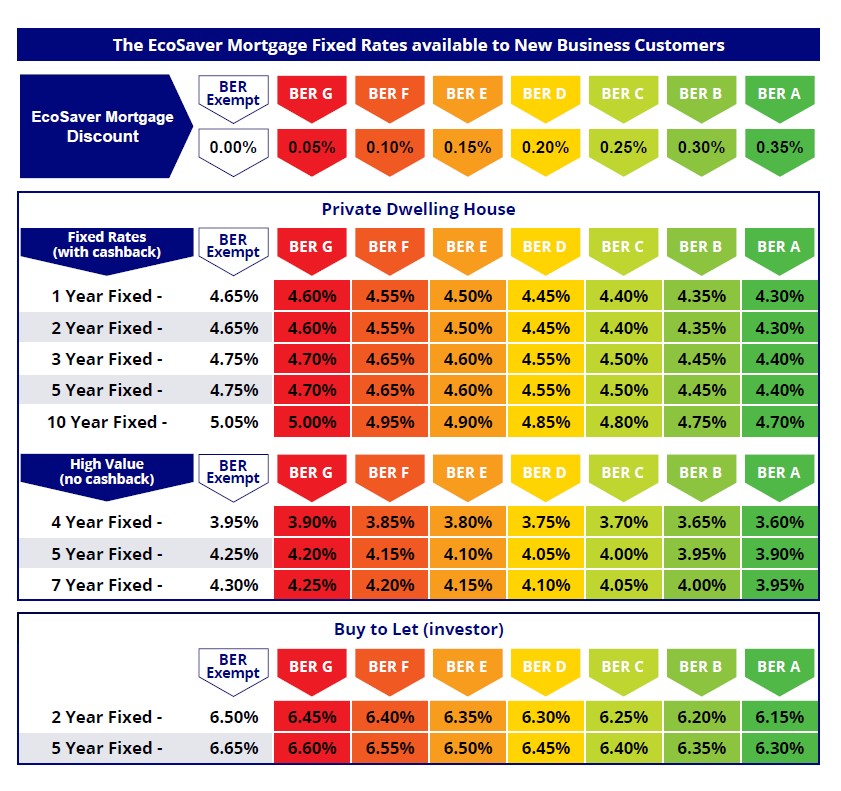

What are EcoSaver Mortgage rates for new mortgage applications?