Open Banking

Open Banking has been introduced to offer you greater control over your data, giving you the option to securely share your current account and credit card information and make payments directly from your current account by using Third Party Providers, known as TPPs. These could include banks, online retailers and financial technology (Fintech) providers.

Open Banking is happening because of the introduction of regulations, which set out to make the banking industry more competitive and to encourage the development of innovative new products and services which make managing your finances more straightforward and enable you to save both time and money.

However Open Banking won’t be for everyone, and we won’t share your data unless you tell us to. You are always in control, so if you try it and decide it’s not for you, you can stop sharing data at any time.

Where can I find more information?

We have created a downloadable guide to introduce Open Banking, explaining what it could mean for you and the steps you need to get set up.

You can also see our list of Frequently Asked Questions below for any queries you may have. Alternatively visit the links below to read more about Open Banking:

Open Banking General Queries

- What type of services will Open Banking enable?

The introduction of Open Banking brings endless possibilities and the potential for a wide range of third party services to be created. There are two main types of TPP:

1. Third Parties that use your account data

For example, if you have current accounts or credit cards with different banks, TPPs could allow you to see them all in one place without having to log in to separate online banking profiles. A TPP could also use transaction information from your current account to provide a personalised recommendation on what current accounts offer you the best price or the most relevant features.

2. Third Parties that can initiate payments directly from your current account

For example, when buying goods or services online, you may be able to choose one of your current accounts to pay from, rather than paying with your credit or debit card.

Note: While TPPs can offer you either of the services above, it is also possible for the same TPP to offer you both types of service.

Note: Once the TPP has your consent and has obtained your information, they’ll be responsible for the security of that data. We can’t control how it will be used.

Note: Once you have authorised a TPP to make a payment, you may not be able to stop it.

- How safe is Open Banking?

Open Banking is backed by financial legislation, The Payment Services Regulations 2017, designed to provide you with safety and security. When you try to give a TPP access, Bank of Ireland will check that it is authorised and regulated by the Financial Conduct Authority (FCA), meaning that it is forced to comply with strict security mechanisms and data protection laws, just like your bank.

If you choose to use Open Banking, you will need to provide your consent for the TPP to access your data or make payments from your current account. To do this, the TPP will direct you to a secure Bank of Ireland log in page where you verify yourself and provide your authority to the bank.

Remember that TPPs can’t access your information without your consent, and you can always choose to stop sharing data at any time.

- Who can use Open Banking?

You are in control and can choose whether you’d like to use Open Banking or not. Both Personal and Business customers can use Open Banking as follows:

- Through 365 online if you have a personal current account, business current account, or credit card.

- Through Business On Line if you have a business current account, call account or commercial credit card.

- Do I have to use Open Banking services?

You are always in control and can choose whether you’d like to use Open Banking services or not. You will need to provide your consent for the TPP to access your data or make payments from your current account.

Remember that TPPs can’t access your information without your agreement, and you can always choose to stop sharing data at any time.

Getting set up for Open Banking

- What do I need to get started?

Open Banking is available on 365 online, if you have a personal current account, business current account, or credit card, and Business On Line, if you have a business current account, call account or commercial credit card.

If using 365 online, you must:

Have the latest Bank of Ireland app downloaded and registered on your security device. A security device is just a smartphone or tablet linked to your account and has the Bank of Ireland banking app downloaded onto it.

Your phone number will need to be registered to receive security codes. If you have not downloaded the latest Bank of Ireland app or registered your security device, details on how to do this are available on our website.

For business current account customers using 365 online, only the authorised user will be able to use Open Banking.

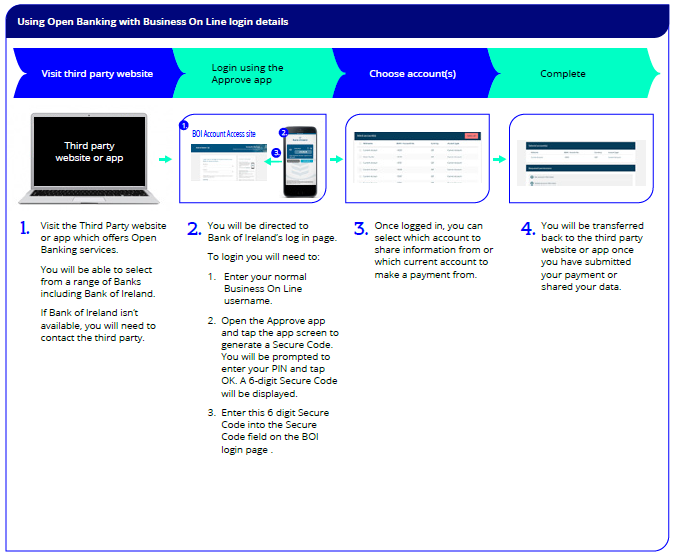

If using Business On Line:

You will already be using the Approve app and no further registration is required. Your administrator will need to provide you with the necessary group access to enable you to use Open Banking services. They will also need to provide appropriate payment permissions and authorisation limits to allow you to setup payments through Open Banking.

Personal and Business Customers can find out more information about online banking on our website.

Using Open Banking

- How do I use Open Banking services with my 365 online or app login details?

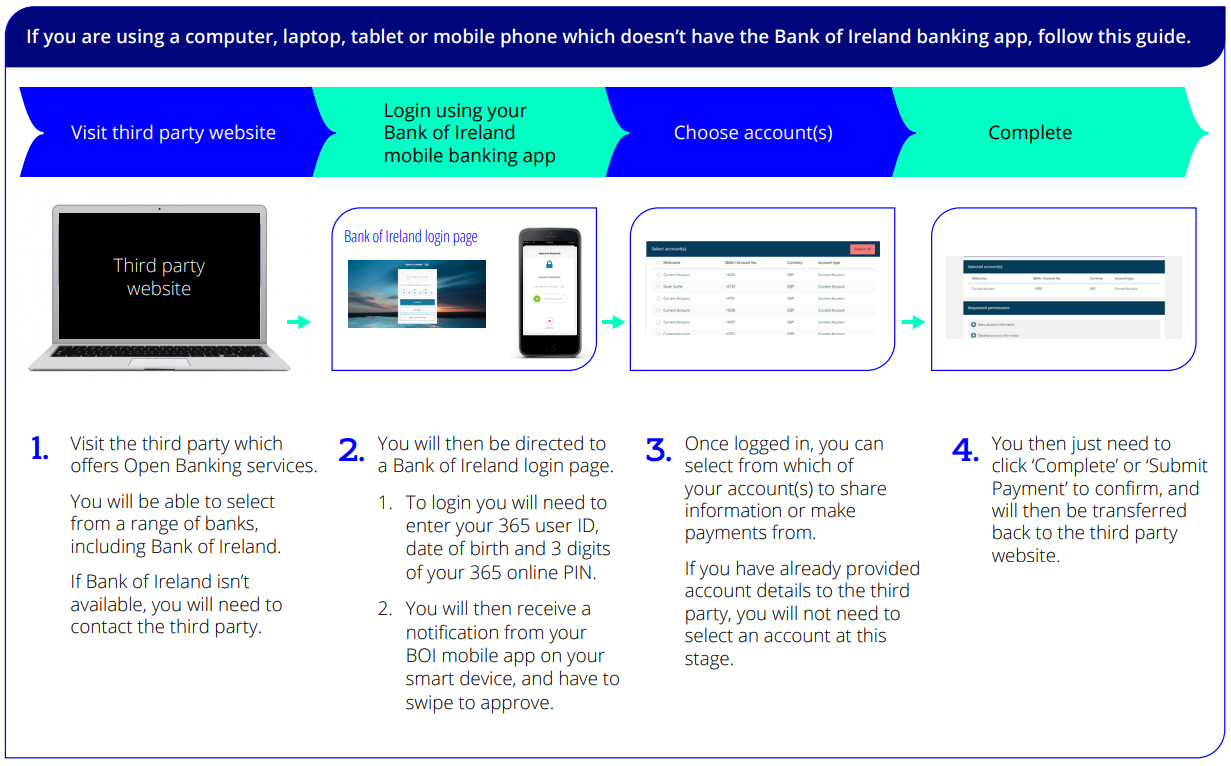

Go to the website or app of the registered third party provider and select the services you wish to use. They will redirect you to a secure Bank of Ireland login page or the Bank of Ireland app, where you will have to login to use Open Banking services. The step-by-step guide below describes how to login.

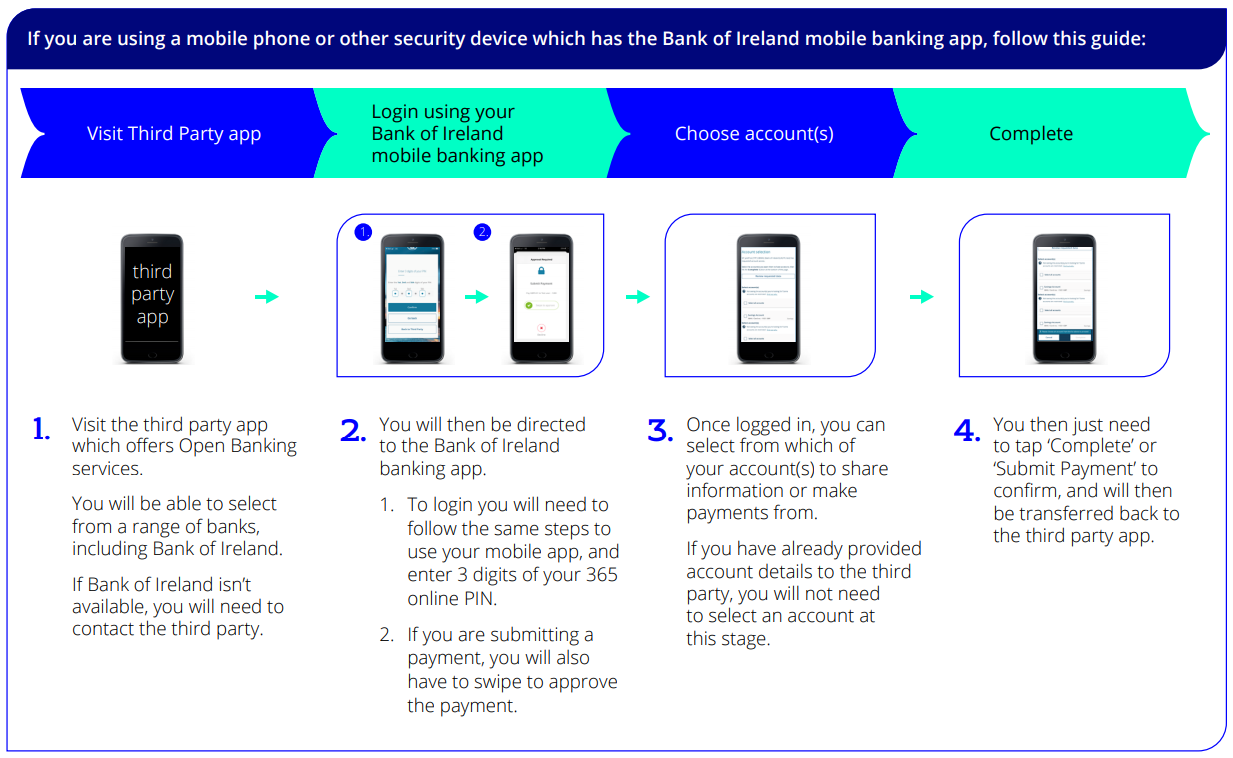

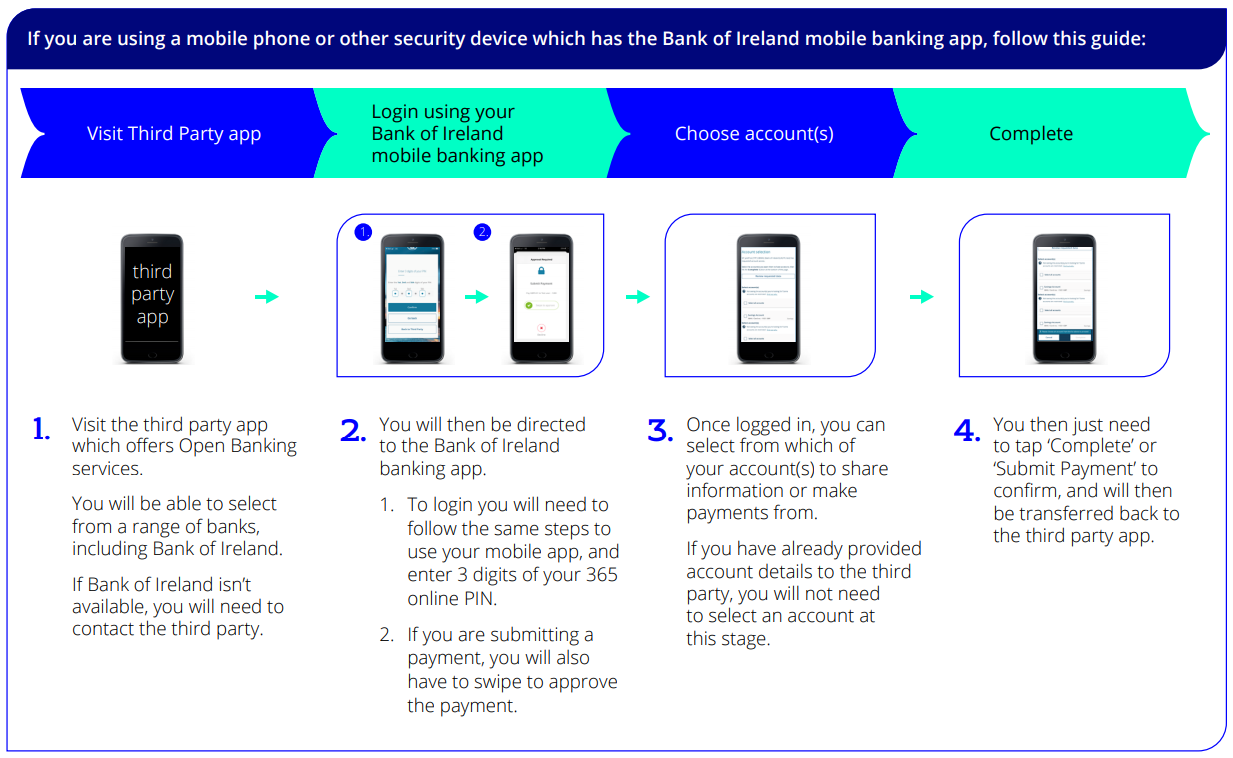

If you are using a mobile phone or other smart device which has the Bank of Ireland mobile app, follow this guide:

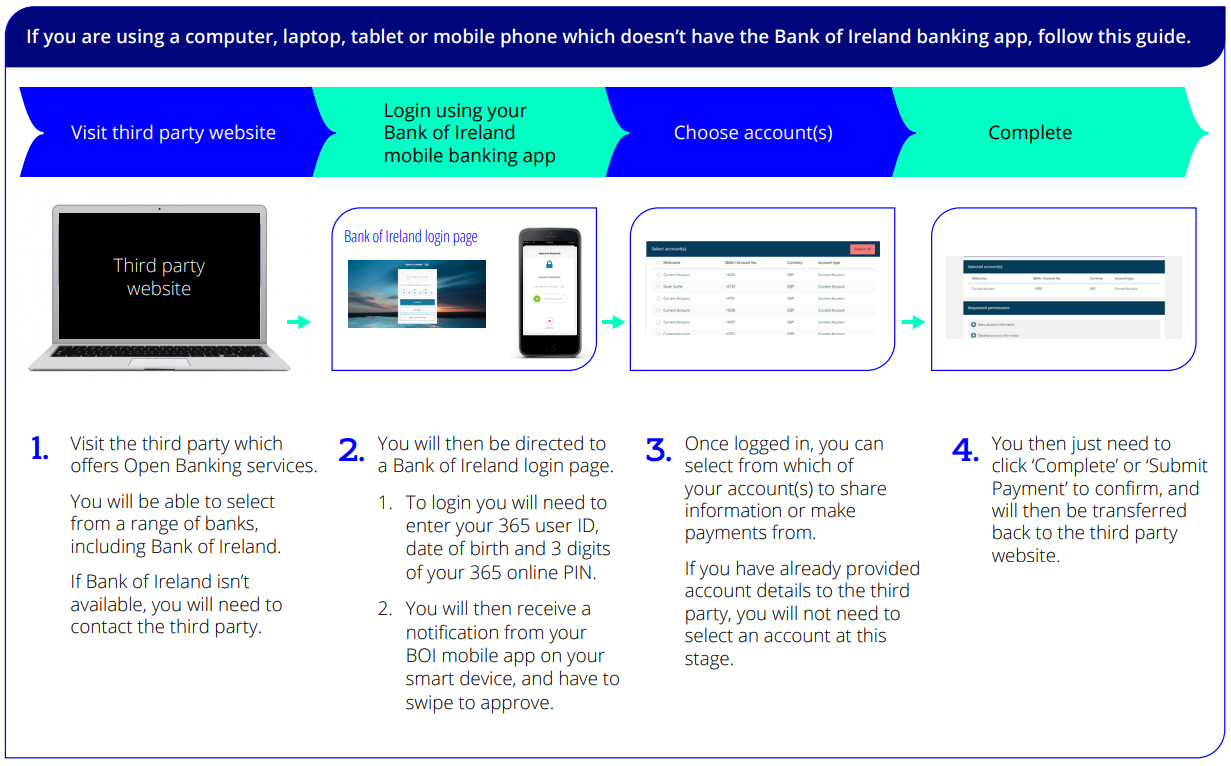

If you are using a computer, laptop, tablet or mobile phone which doesn’t have the Bank of Ireland mobile app, follow this guide:

Note: The TPP should clearly explain what information it is going to use, how it will be used and how long it will be kept for.

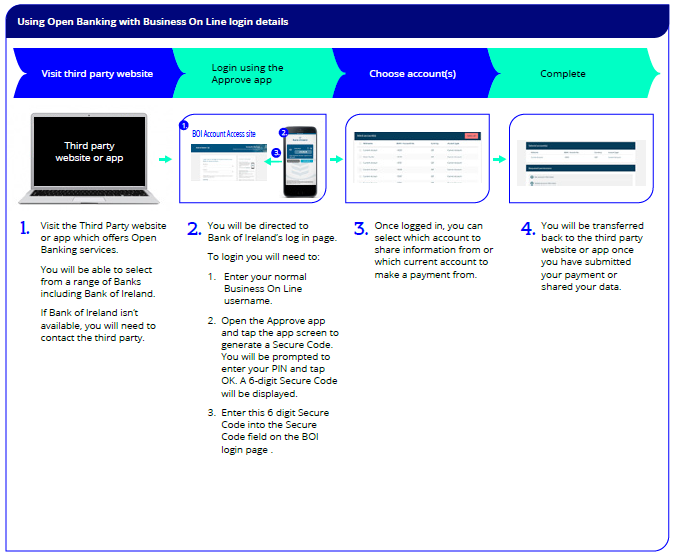

- How do I use Open Banking services with my Business On Line user ID?

If you wish to avail of Open Banking Services your Business On Line administrator will need to provide you with the necessary group access to enable you to use Open Banking Services. Once you have the necessary access go to the app or website of the registered third party provider and select the services you wish to use.

For everyday Business On Line Help and Support please click here.

Note: The TPP should clearly explain what information it is going to use, how it will be used and how long it will be kept for.

- What is consent and why does a TPP need it?

In order to use a TPP's services you must authorise them to access your data or make payments from your current account – this is known as giving consent. After providing your consent, the TPP will direct you to a secure Bank of Ireland log in page where you verify yourself.

- How long does consent last for?

When you give consent, you will agree with the TPP how long your information will be shared for - Bank of Ireland will only share the data for the duration you have agreed with the TPP.

- How do I make a payment using my current account?

You can choose to pay directly from your Bank of Ireland current account without the need for a debit or credit card. Any TPP offering this service will confirm the payment amount and ask if you want to pay directly from your bank account. After you verify yourself via the secure Bank of Ireland log in page we'll show you a summary of your payment, the amount and where your money will be going. If you have more than one current account with us, you'll need to confirm which account you'd like the money to be taken from, unless you’ve already selected an account with the TPP. Once you've given your consent, the payment will be made from your chosen account. Business On Line administrators will also need to ensure the user has appropriate payment permissions and authorisation limits to allow them to setup payments through Open Banking.

- What is a recurring payment?

It is a form of payment instruction where consent is provided to TPPs to allow them to make a series of payments on a customer’s behalf within agreed parameters.

- Why is my recurring payment failing? (Business On Line users only)

Please ensure your Business On Line Username has appropriate payment permissions and authorisation limits to facilitate ongoing recurring payments. If a recurring payment value requires dual authorisation (as configured by the BOL Administrator in their Payment Panel) then the payment will fail. The Business On Line Administrator must ensure that their User has ongoing appropriate payment permissions and a sole authorisation limit of an appropriate level to facilitate a recurring payments. For further information, please contact your Business On Line administrator.

Other Queries

- Where can I see all the TPPs that I have provided consent to?

You can view current and historic consents that you’ve given to TPPs, and remove access, through 365 online or Business On Line. If you used your 365 user profile to access Open Banking services, view and manage consents through 365 online. If you used your Business On Line profile, view and manage consents through Business On Line. On 365 online, click on Profile, and select Open Banking Connections. On Business On Line, click on Admin, and select Open Banking Connections.

- Can I use my joint account for Open Banking Services?

In order for a TPP to access joint account information, all parties on the joint account must provide their permission for Open Banking Services to Bank of Ireland.

This service is applicable to joint personal accounts only. Please contact Bank of Ireland if there are any further queries on the account permissions currently present on your account or if you wish to change the account permissions of your joint account. You can do so by contacting us on 0345 736 5555* or by calling into your local branch.

- How do I stop sharing data through Open Banking?

You only need to this if you have previously given a TPP your consent to securely access your account information and want to stop using its Open Banking service.

You can do this by contacting the TPP directly, or through 365 online or Business On Line. On 365 online, click on Profile, and select Open Banking Connections. On Business On Line, click on Admin, and select Open Banking Connections. Select the TPP you wish to remove access, and click ‘Disconnect’.

*Calls may be recorded, monitored and used for training and compliance purposes. Calls to 03 numbers cost the same as calls to 01 or 02 numbers and they are included in inclusive minutes and discount schemes in the same way. Call costs may vary dependent upon your service provider. Lines are open 9am – 5pm Mon-Fri, 9am-1pm Sat, Closed Sundays.

Site links

Bank of Ireland Group plc is a public limited company incorporated in Ireland, with its registered office at 2 College Green, Dublin, D02 VR66 and registered number 593672. Bank of Ireland Group plc, whose shares are listed on the main markets of the Irish Stock Exchange plc and the London Stock Exchange plc, is the holding company of Bank of Ireland.

Bank of Ireland is regulated by the Central Bank of Ireland. In the UK, Bank of Ireland is authorised by the Central Bank of Ireland and the Prudential Regulation Authority and subject to limited regulation by the Financial Conduct Authority and Prudential Regulation Authority. Details about the extent of our authorisation and regulation by the Prudential Regulation Authority, and regulation by the Financial Conduct Authority are available from us on request. By proceeding any further you will be deemed to have read our Terms and Conditions and Privacy Statement.