Mobile Banking app

We’ve launched a new app that will replace your existing mobile and tablet banking app. The new Bank of Ireland mobile app will have all the features of the Bank of Ireland desktop platform, as well as enhanced security. This means you will now be able to:

- Check and download up to 7 years’ statements

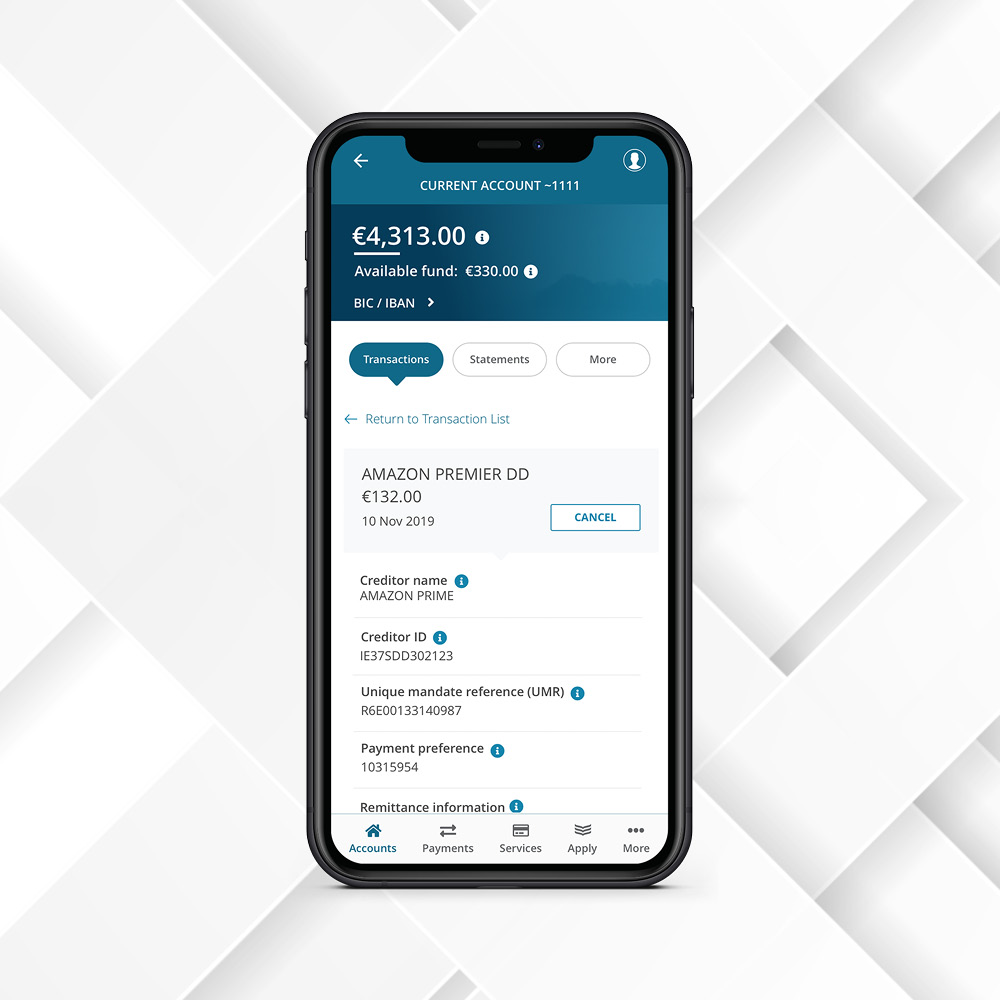

- Manage direct debits

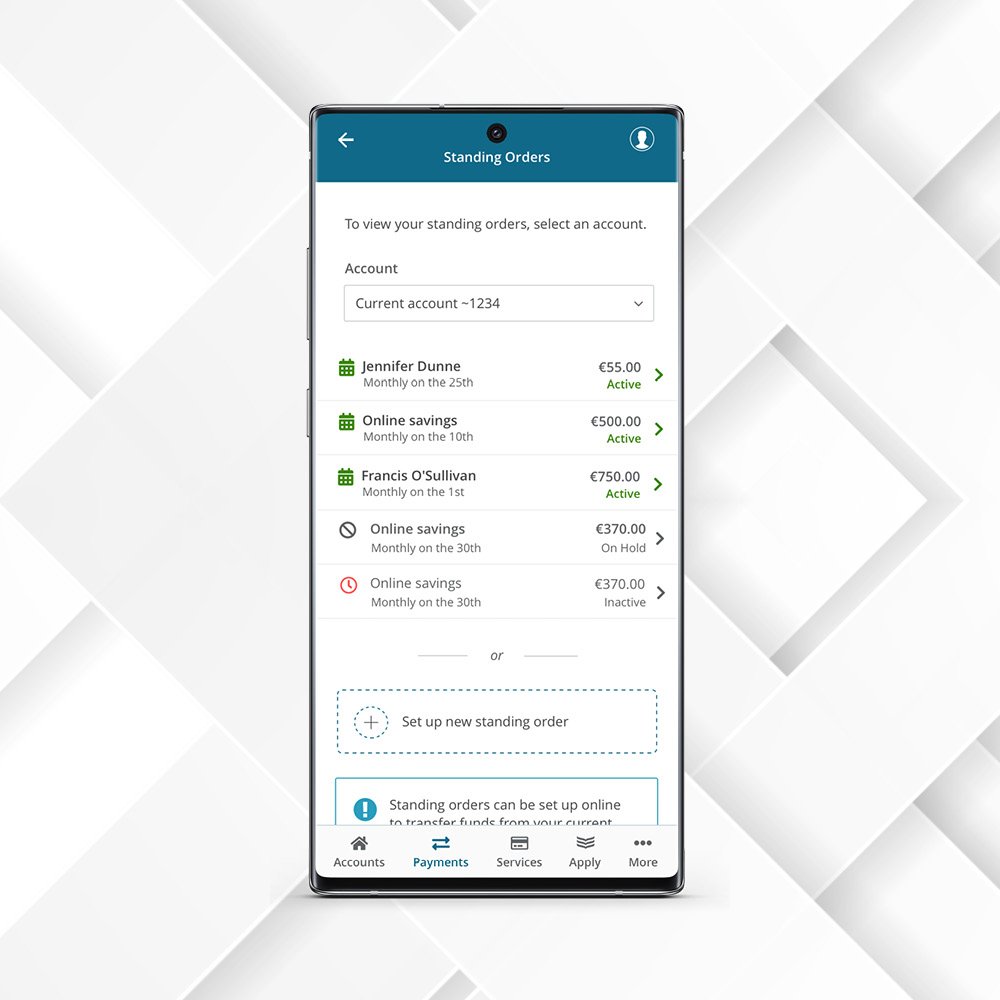

- Set up standing orders

- Keep a closer eye on your money and more – all from your mobile phone.

Guides on how to do this and more can be found in our Help Centre.

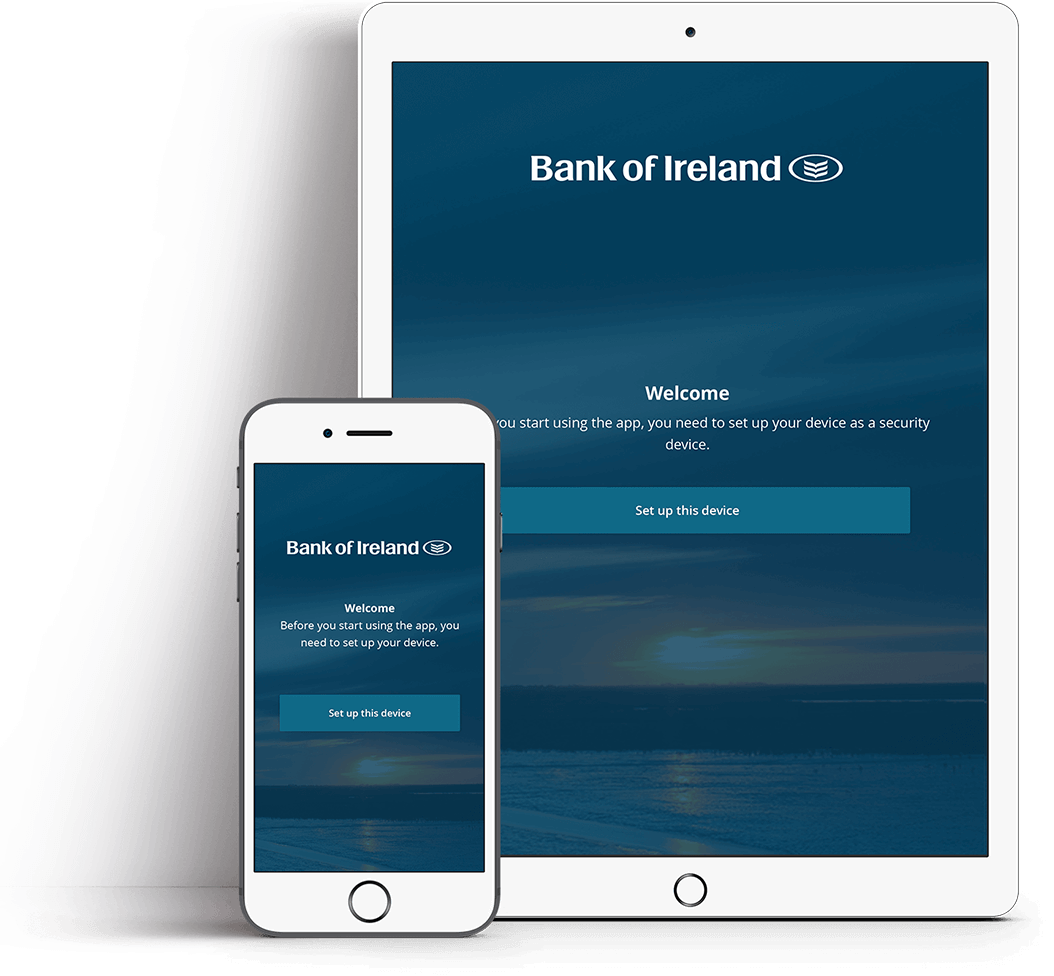

What do you need to do to get the new app?

To switch over to our new app, there are a few key steps:

How will the new app differ from the current one?

The new app will make your day-to-day banking experience easier by adding all the features of the Bank of Ireland desktop platform to your new mobile app. You’ll now be able to:

- View and download up to 7 years’ statements

- Check transactions in progress

- Manage your direct debits and standing orders

- Change your contact details

The app also comes with enhanced security known as Strong Customer Authentication (SCA).

Whether you’re just getting started with digital banking or want to find out more about the new mobile app, here is a support video and guide that will help you get started with the new app. If you are a tablet user, check our guide for further information on how to get set up. Additional support can be found in our Help Centre.

Register a backup device

SCA links your smartphone to your online banking access. We strongly recommend you also set up the mobile banking app on another smartphone or tablet in case you lose your mobile phone or don’t have it handy when you need to access mobile banking. Watch the video below to find out more about setting up a second device.

Banking 365 T&C’s

Click here to view our Banking 365 terms & conditions page.